As a result, exchangeability swimming pools decentralize funding results and you will speed up the process of facilitating trade by eliminating the need for businesses to help with trade quantities.

In addition to earning charges, liquidity swimming pools enable it to be users so you can risk their cash. Uniswap lets users in order to easily trading the countless offered tokens using their liquidity pools. Crowdsourced exchangeability swimming pools help in exchange assets through the pooling out of finance.

Start out with Uniswap v4 on the Ethereum, Polygon, Arbitrum, Feet, and more.

If this sounds like their wallet’s first time exchange it token having the newest Uniswap Process, you will want to accept the brand new token first. That it more approval are an additional covering of defense to safeguard your own finance. Once you’ve joined the amount you want to exchange, the new Uniswap car router finds out an educated rate and you can automatically computes the degree of the other token you’ll receive.

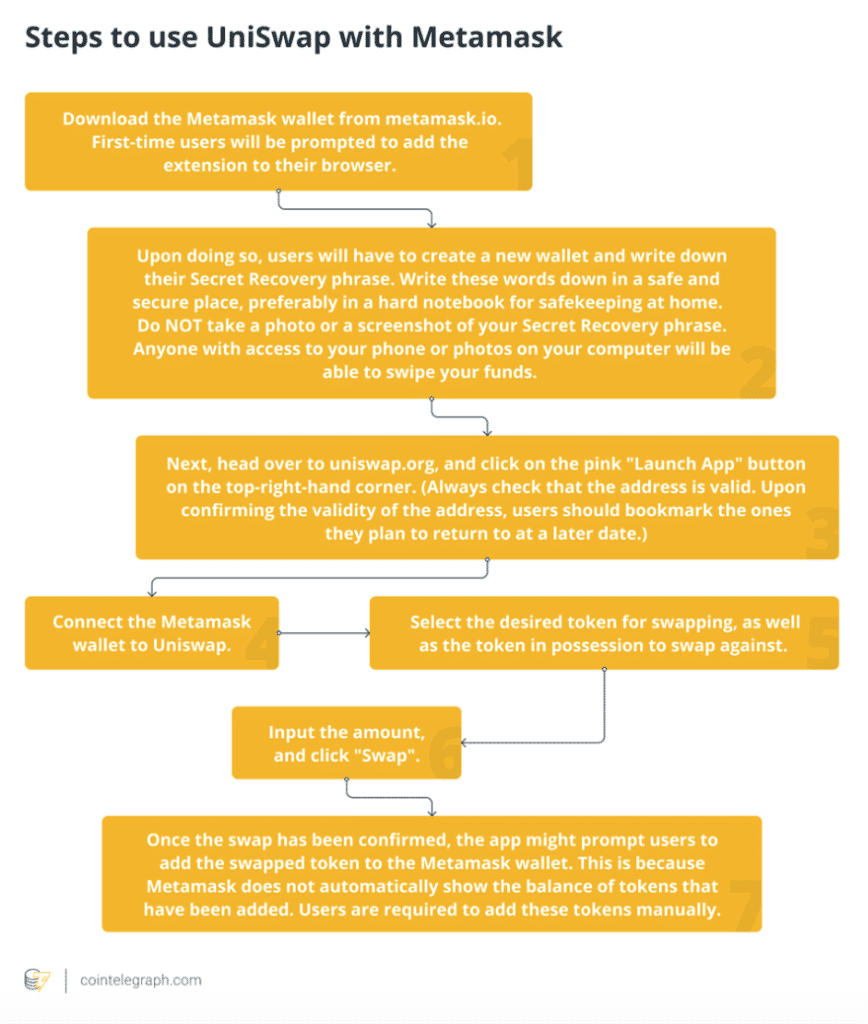

Step two. Hook The MetaMask Handbag

You will then have to confirm the fresh trading by clicking “Swap” and you may approving the newest Ethereum bag purchase. Once you’ve connected your own handbag, you can purchase the tokens you want to trade. You can select many tokens, either by the navigating to the token info webpage, or going into the token myself. Decentralized exchanges (DEXs) for instance the Uniswap Process give several advantages more than old-fashioned central transfers (CEXs).

Cryptocurrency try a modern electronic asset and you may type of exchange you to depends on blockchain technical that is protected by cryptography, making certain the new assets can’t be forged. Fundamentally, cryptocurrencies act as alternatives to help you old-fashioned currencies including the euro, money, yen, and others. As opposed to electronic financial currency, the key distinction is the fact cryptocurrency works inside a great decentralized program, without central expert controlling they. While you are you can find choices readily available, Uniswap’s dedication to shelter, transparency, and associate empowerment will continue to make it a respected option for of a lot regarding the crypto community. Whether or not you’lso are an experienced buyer or a novice to everyone out of DeFi, Uniswap now offers an extensive and you will associate-amicable system to own change and you can exchangeability provision.

Next you must find the number we want to provide to this exchangeability pool. Remember that you should deliver the related proportion for each and every exchange partners. SushiSwap is actually a shell from Uniswap that was incentivizing pages to help you relocate their funds on their program having SUSHI tokens. As with any DEXs, investors manage their funds plus don’t must deposit it to your exchange.

The fresh change helps all Ethereum suitable wallets, including MetaMask. Since November 2021, Uniswap has a whole really worth closed of over $10 billion, according to DappRadar. Such as, if you want to buy bitcoin, you can either place market purchase, which will immediately have the financing at best available rate, otherwise place a threshold acquisition.

Uniswap often revert the brand new Ethereum your sent when a transaction fails, nevertheless obtained’t reimburse the new fuel fees. Uniswap provided pages which have significant developments with each iteration. Users just who used the program before Sep 2020 obtained UNI tokens while the Uniswap DEX’s formal governance token.

Uniswap is actually a good decentralized exchange that enables users to exchange cryptocurrencies. Introduced inside November 2018, it is one of the first decentralized money (otherwise DeFi) applications allowing people to exchange one Ethereum token to a different Ethereum token. The newest replace’s prominence provided birth in order to a V3 type which have concentrated liquidity and flexible fees, and this enhanced an individual experience to possess people and you may exchangeability organization the same. Uniswap will use the brand new UNI governance tokens to market people effort, offer liquidity mining, and fund other companies to the an excellent of the process. When you have made use of Uniswap, just be eligible to claim as much as eight hundred UNI tokens for only linking the bag.

Multiple points make the open guide design reduced DEX-amicable, in addition to exchangeability concerns. DeFi protocols give certain incentives so you can liquidity organization as part of an excellent vampire assault. In the a vampire attack, the new exchangeability seller try drained of a process supposed to be assaulted. An identical procedure occurs in the stock market whenever market manufacturers operate. A market founder try a buddies you to always deals a certain stock by the setting large requests. Knowing how to use Uniswap today will allow you to choose whether or not it’s correct.

- It’s a collection packed with unicorns, mathematics doodles, and – an actual handbag.

- The easiest method to do this is always to insert the brand new deal target of one’s wanted token.

- Although not, that have v3, it is possible to have zero exchangeability to thrive inside the a specific budget.

- That have wise contracts, you just insert cryptocurrency (such as Bitcoin) for the program (for example a great vending servers) to execute the brand new package.

- In may 2020, Uniswap v2 delivered new features and you may optimizations, function the newest phase to own rapid growth in AMM use.

- Buyers come together personally on the wise contracts on the blockchain when playing with a great DEX.

In return for bringing liquidity, LPs earn trading fees made by the new pool. Anybody can become an exchangeability seller, a transformative switch to doing financial locations. Liquidity pools, which energy the brand new Uniswap program, are essential to decentralized fund. For each liquidity pond is a swimming pool out of tokens closed in to the a great smart deal. These tokens, which can be or even inaccessible to help you typical investors, are acclimatized to helps change through the supply out of liquidity.

Once over, next click on the “Migrate” key in order to processes the brand new consult. The final feature inside Uniswap’s v3 are Cutting-edge Oracles which is an update to the TWAP (time-adjusted mediocre speed) Oracles of your own v2. The newest TWAP Oracles was a crucial element of DeFi structure and have been already used in various projects such as Compound and Reflexer.

The fresh V3 version in-may 2021 marks the modern last iteration of your change. Pressing the newest cogwheel will show a lightbox which have numerous options, however, at the top, you will observe ‘slippage endurance’. For individuals who lay a good slippage endurance out of 0.1%, by far the most you are going to pay money for your possessions is 0.1% over the place rate – the current market price of your asset. Get the resource you want to change to own regarding the list in the bottom container.